CAC & LTV are confusing! So I have simplified them to get you up to speed (fast)

CAC is the average cost of acquiring one new customer while LTV tells you how much profit your company can expect

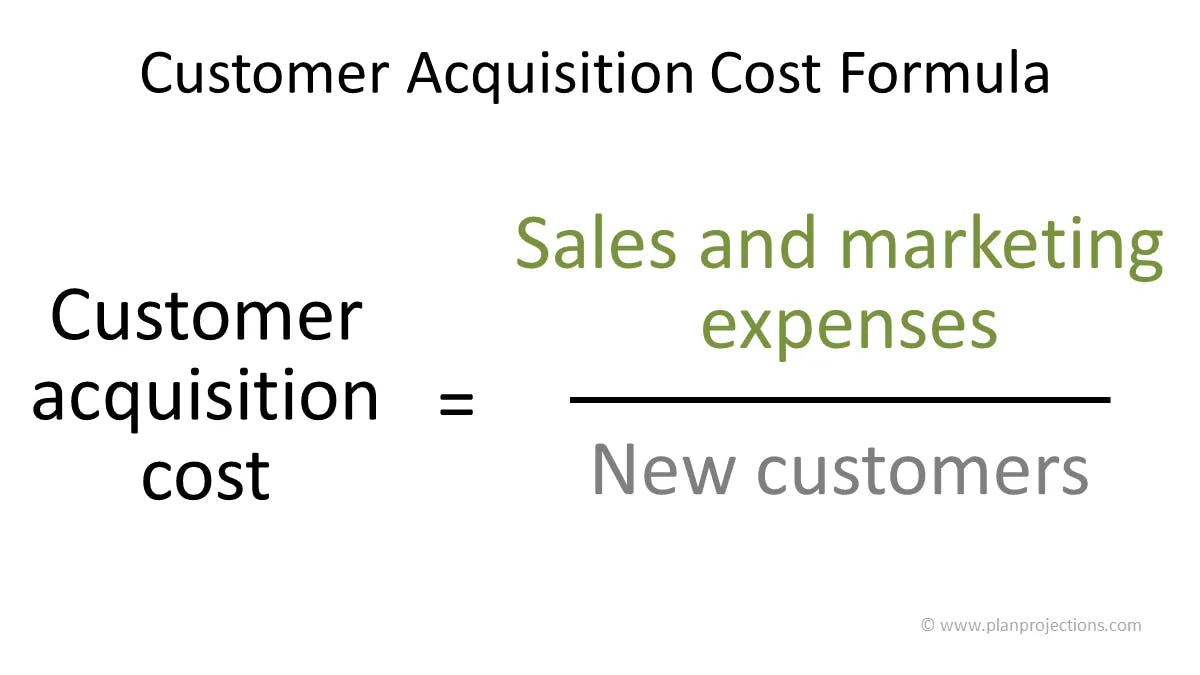

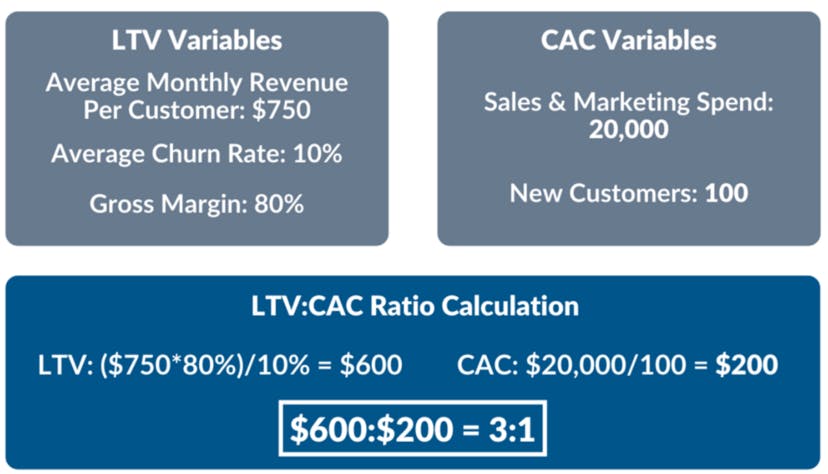

Customer Acquisition Cost (CAC) is the average cost of acquiring one new customer. Just add all your Sales and Marketing expenses and then divided them by the customer you have acquired.

Paid CAC vs Blended CAC

Paid CAC only includes advertisement spending hence it will help you understand the effectiveness of one channel while Blended CAC includes Salaries along with Sales and marketing expenses and gives you the overall snapshot of your business.

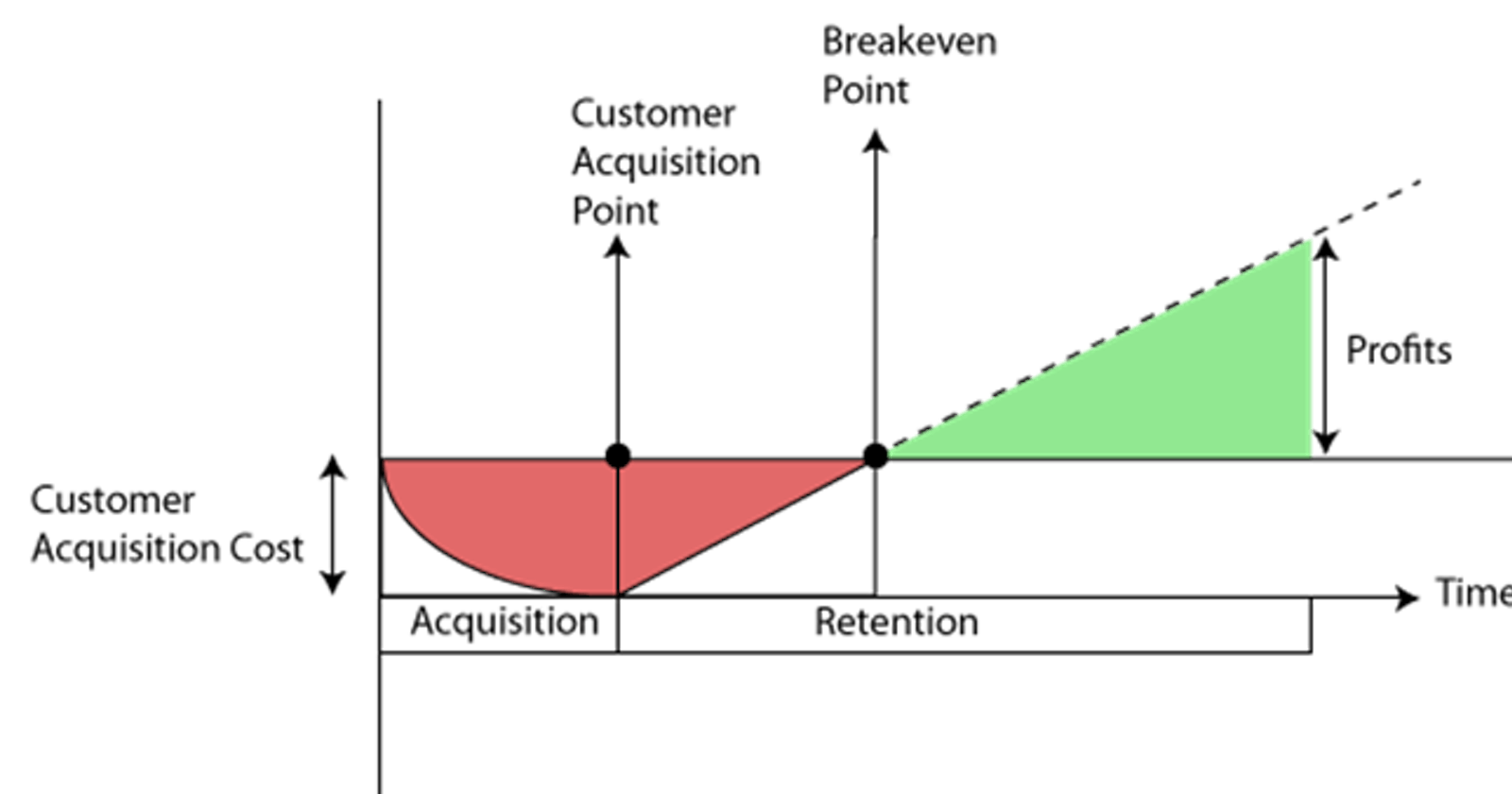

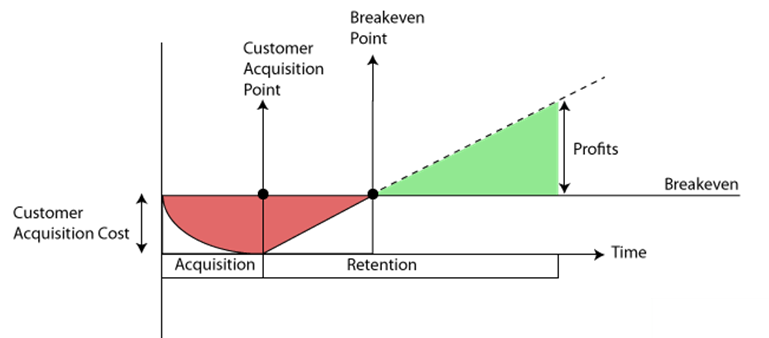

CAC Payback

How quickly a start-up receives back the cash it spent on acquiring that customer. " Fast CAC payback means a start-up can recycle its cash quicker and raise less capital (and lower dilution)"

CAC payback in Regular Sales vs SaaS sales - One of the reasons software products do well in the market is because of monthly cash flow or reoccurring payments.

Customer Lifetime Value (CLTV) CLV tells you how much profit your company can expect from a typical client over the course of the relationship.

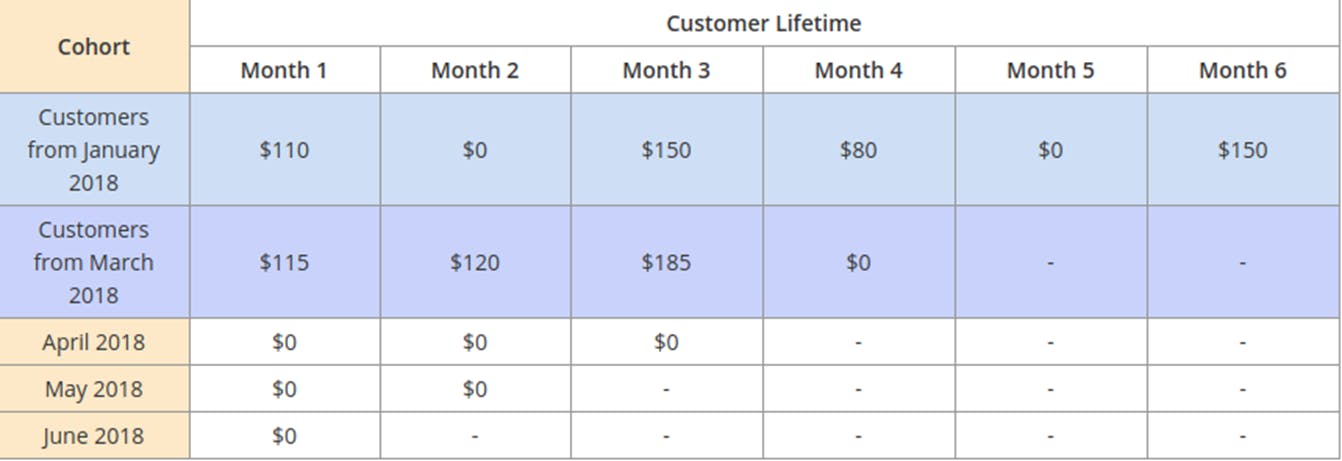

You can use historic data or a cohort-based approach to calculate CLTV

Cohort based approach gives you a forward-looking picture of CLTV by understanding the user retention with the product.

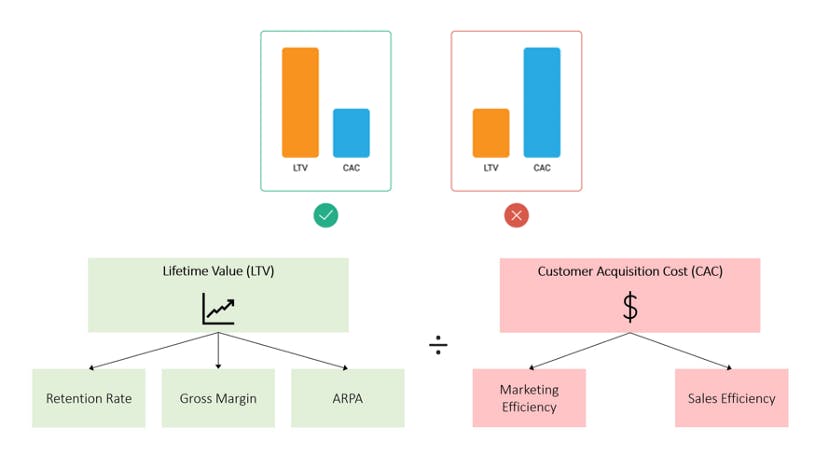

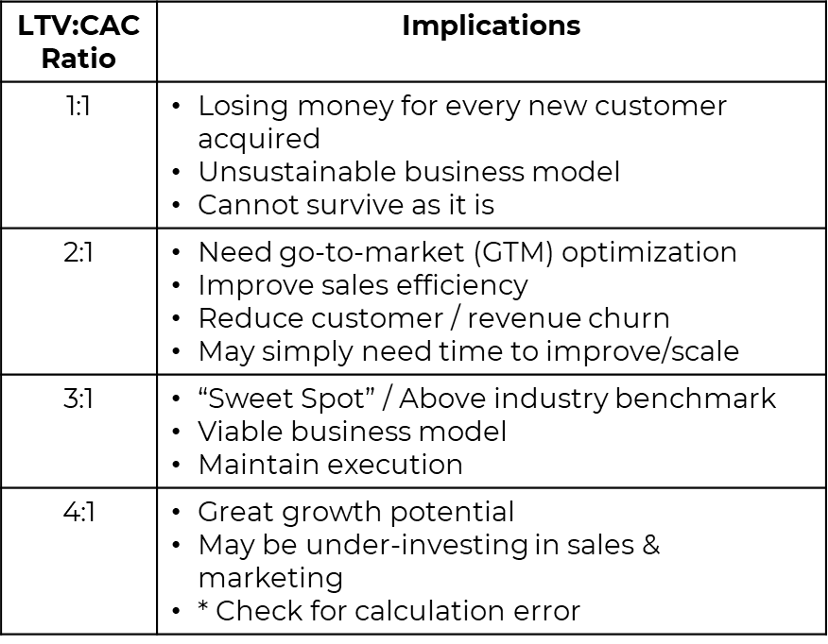

CAC to LTV Ratio LTV / CAC is a widely used ratio to determine how much customer value a product provides relative to the cost of acquiring that customer.

To become profitable your LTV to CAC ratio should be higher than 3.

Here is the LTV to CAC Ratio and its Implications

Spending lots of money to acquire unprofitable customers is a recipe for disaster

If you want to learn more about all these growth metrics for your startup then I have made a course on

SaaS Masterclass: Sales, Marketing, and Growth Metrics

If you want me to write more on these topics. Please clap and follow me. As this will help me understand that you are liking the content.

Just clap👏 and follow 👏 if you liked the content. customers.